Our Services

Individual Tax Returns

We will establish all of your entitlements so that any refund due will be maximized. Your taxation return will be completed making sure that all income is declared so you can have confidence that your obligations to the Australian taxation Office have been met. Most of the time people get their refunds in their accounts within 10-15 days. Please Call 0422 605 962.

Sole Trader Tax Returns

We’re passionate about helping small businesses with their financial and accounting needs. Whether you own a small business or haulage business, we guarantee to offer professional and very affordable services that you can rely on. Please call: 0422 605 962. or contact via email to lodge your tax return.

Company Tax Returns

A company tax return is one of the many obligations that comes with running a business, no matter how large or small. We can make it easier than ever to manage the co-ordination of your company tax return. We’ll help you find deductions you may have missed, as well as discuss business structures that may help to reduce your tax obligations.

Prior year returns

FDo you have a previous year tax return that is overdue? Or maybe you have a few late tax returns you’ve been avoiding? Many people don’t lodge their tax returns when they have had very low income or have been un-employed for a period of time. Don’t worry: You’ve come to the right place. We’ll get your tax returns done for all years and avoid you from late fee.

Late ATO Lodgments/ returns

It's not too late! Most people generally need to lodge an income tax return every year. However, some may have been too busy, overseas, or found that it was just too complicated to lodge their tax return. If you have not lodged a tax return for a few years or you have a tax return outstanding or overdue, no matter the reason, getting up to date now will give you peace of mind.

Early tax returns - leaving Australia

Are you leaving Australia prior to 01 July? Will you earn no further Australian income between now and 30 June? If you answered yes to both of these two questions, then you might be eligible to lodge your tax return earlier. We’ll help you get the maximum refund for your early tax return. Please call: on 0422 605 962 to talk to an professional accountant.

ABN Registration

Every Business needs an ABN and GST registration to claim GST credits for any GST have paid on goods/services for business, when business invoices for goods or services it will need to quote its ABN so that other businesses do not withhold tax at the highest marginal rate.

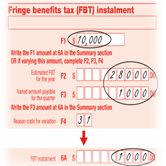

Fringe Benefits Tax (FBT) returns

Fringe Benefits Tax or FBT applies to the provision of a range of non-wage employee benefits, including travel and expenses. The FBT system carries a number of reporting and compliance obligations that Tax Insights can advise on and support you in meeting and been compliant.

GST registration

You need to register for GST if your GST turnover is more than $75,000 per year. You must register even if you provide taxi or limousine travel for passengers in exchange for a fare as part of your business, regardless of your GST turnover. This applies to both owner drivers and if you lease or rent a taxi.

GST information and returns

GST is goods and services tax. There are 2 methods of accounting for GST: on a cash basis or a non-cash (accrual) basis. The method you use affects when you must account for GST and when you are able to claim GST credits. If you need any help with GST, No Look further you have come to the right place, Call: 0422 605 962.

PAYG assistance

PAYG installments is a system for making payments each quarter towards your expected income tax obligation on your business & investment income for the current financial year. PAYG installments are generally paid by business owners, investors and sub-contractors who earn a certain amount of income, Call: 0422 605 962.

Business Activity Statements (BAS)

The business activity statement (BAS) is a pre-printed document issued by the Australian Taxation Office (ATO) on either a monthly or quarterly basis. It’s used to summarize the amounts of GST payable and receivable by you for a certain period, as well as a range of other taxes including pay as you go (PAYG) withholding tax and ABN withholding tax. Its aim is to allow a business to pay a number of tax obligations in one transaction.

Superannuation

Not sure how much super to pay? When to pay or how to pay superannuation. Call us today so that we can assist you with all the super. You can call: 0422 605 962.

Departing Australia Superannuation Claims

If you are working in Australia temporarily, that doesn't necessary mean that you are going to retire here. But that doesn’t mean that you lose the superannuation money that you have earned. It is your money and you are entitled to take it with you when you leave Australia by claiming (DASP). call: 0422 605 962 If you need help to claim your superannuation.

Bookkeeping

We tailor all our bookkeeping services to fit your needs perfectly. You won’t believe how well we can work with your business to help things run smoothly. Our goal is to help you focus on your business, grow, create, work and play. We will do the back end bookkeeping and make sure everything is sorted with the ATO, and help you understand how your business is performing. Please call: 0422 605 962 .

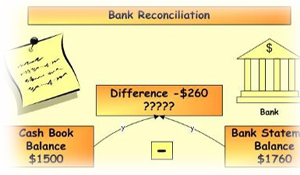

Bank Reconciliations

The purpose of preparing a Bank Reconciliation Statement is to detect any discrepancies between the accounting records of the entity and the bank besides those due to normal timing differences. Such discrepancies might exist due to an error on the part of the company or the Bank. We can help you fix all these, Please Call 0422 605 962 .

Invoicing

we bring you the fast invoice factoring and cash flow finance solutions to keep the cash flowing in your business. One of the most difficult things in small business is securing a smooth cash flow. Without a reliable cash flow you can't take advantage of opportunities as they arise, you can't pay your own bills and you take a risk each time you spend anything. Give us call: 0422 605 962 we’ll help you with everything you need for your business.

Xero

Our beautiful cloud-based accounting software connects people with the right numbers anytime, anywhere, on any device. Working in the cloud will give you a better overview of your finances, and improve collaboration with your team. We strongly suggest you to get the Xero for your Business, and we provide full support to our clients. Please let us help you setting up Xero for your business, Call:0422 605 962 .

Record keeping

Good record keeping is essential for anyone in business because it makes it easier to manage your cash flow, meet your tax obligations and understand how your business is performing. You can keep invoicing, payments and other business transaction records electronically or on paper. The principles are the same for each, however keeping electronic records will make some tasks easier.

Management Reports

A management report is a formal business document that discloses a company's profit and loss statements in one- to-three month’s periods. Management reports are utilized by higher management professionals, such as CEOs and CFOs, to determine where the business needs to focus on developing future product or service revenue streams.

Business Structures

Our role is to help you navigate your way through all the important aspects of running your business. Whether its tax legislation, asset protection, succession planning or general business advice. If you are setting up a new business, we can advise you on the best structure for your business. We can also arrange for the new structure to be setup and registered for all reporting obligations.

General Business advisory

Successful businesses do not happen by accident. From start-ups to restructuring issues to succession planning, many clients use us as their sounding board for future plans, fine tuning ideas and providing a reality check to identify any potential flaws.

Small Business assistance

If you are starting a small business on a limited budget, and have no idea what you should do. We can help you setting up each and every aspect of your business perfectly, and you can manage it on your own.

Rental property and Negative gearing

By deducting rental property expenses on your tax return you can access an incredible range of possible tax deductions that can boost your tax refund and leave more rental income in your pocket. It’s important to stay on top of your rental property tax deductions and claim them correctly to maximize your tax refund.